The New DefenseTech Game: Lessons from "Moneyball" and the Need for Smarter Metrics

Shifting from traditional giants to innovative startups in the age of AI, quantum and autonomous systems. A call for smarter metrics and outcome-based strategies to ensure technological superiority.

The defense sector is undergoing a seismic shift as emerging tech companies like Anduril, Shield AI, and Saronic challenge the dominance of traditional defense giants such as Lockheed Martin, Raytheon, and Boeing. This transformation is fueled by the Department of Defense's (DoD) push to adopt cutting-edge technologies like artificial intelligence (AI), quantum computing, and autonomous systems.

However, this shift raises critical questions about whether the current approach to fostering next generation defense primes is optimal, or if a "Moneyball" strategy focused on smarter metrics and smaller wins could yield better results.

The New Players in Defense

Tech companies such as Firestorm and Chaos Inc, are driving significant momentum in this movement. Firestorm specializes in autonomous systems including rapid manufacture, while Chaos Inc focuses on Coherent Distributed Networks (CDN) redefining the future of sensing and detection. Other notable entrants include:

Saronic: Innovating autonomous maritime vehicles for naval operations.

Shield AI: Developing autonomous drones for complex combat scenarios.

Skydio: The largest U.S.-based drone manufacturer with significant defense contracts.

Rebellion Defense: Building AI software for threat detection and operational planning.

These firms are part of a broader consortium aiming to reshape the defense landscape by leveraging Silicon Valley's agility and innovation. The goal is to deliver cost-effective, AI-driven technologies that can respond to modern conflicts faster than legacy primes and contractors.

However, as these players rise, there’s an increasing need to evaluate their readiness and impact systematically.

Historical Context: The "Last Supper"

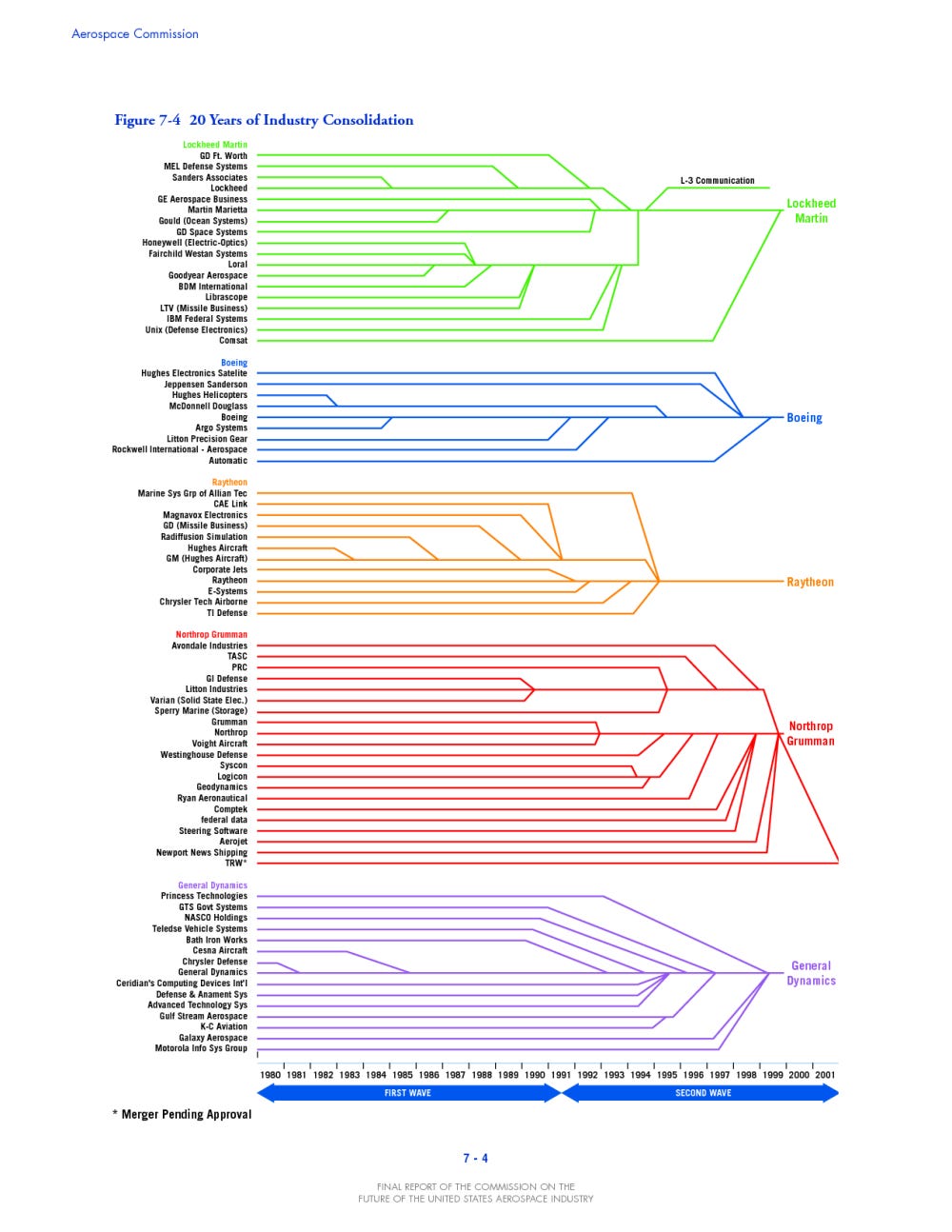

The current pivot echoes the 1993 "Last Supper," a pivotal event where Pentagon leaders urged defense contractors to consolidate in response to declining budgets. This led to massive mergers, reducing the number of major defense primes from 51 to just five within a decade. While this consolidation created efficiency during peacetime, it also entrenched bureaucratic processes that now hinder rapid innovation.

Today's efforts to foster new primes represent an attempt to undo some of these inefficiencies by injecting fresh competition into the market. However, this strategy risks repeating history by focusing on creating large-scale players rather than fostering a diverse ecosystem of smaller innovators.

Key Successes in Adoption

Several programs highlight the successful integration of emerging technologies:

Project Overmatch: Shield AI's selection for this U.S. Navy initiative demonstrates how autonomous systems are being prioritized for networked warfare.

SpaceX's Starlink in Ukraine: A commercial technology repurposed for military use, showcasing how non-traditional players can deliver impactful solutions quickly.

Defense Innovation Unit (DIU): This DoD initiative has streamlined procurement processes to engage startups effectively.

These successes underscore the potential of smaller tech firms to deliver targeted solutions faster and more affordably than traditional primes. However, they also highlight the need for structured frameworks to evaluate readiness and scalability—a gap that the National Network for Critical Technology Assessment (NNCTA) highlighted.

Challenges and Headwinds

Despite these successes, significant challenges remain:

Bureaucratic procurement processes: The Pentagon's acquisition system is notoriously slow and compliance-driven, deterring smaller firms from participating. Legacy rules often prioritize process over outcomes, stifling innovation.

Cultural misalignment: Silicon Valley startups thrive on agility and risk-taking, whereas the defense sector emphasizes reliability and long-term planning. Bridging this cultural gap remains a significant hurdle.

Geopolitical pressures: The U.S. faces intense competition from China and Russia in emerging technologies like AI and quantum computing. These adversaries often operate with fewer regulatory constraints, allowing them to innovate more rapidly.

Technology risks: Emerging systems like AI-enabled weapons are vulnerable to hacking, spoofing, and data poisoning. Ensuring cybersecurity while scaling these technologies is a complex challenge.

A "Moneyball" Approach for Defense

The current strategy of cultivating new primes may overlook the potential of smaller players who can deliver immediate wins.

Michael Lewis’s Moneyball: The Art of Winning an Unfair Game (2003) chronicled the Oakland Athletics’ revolutionary use of sabermetrics under general manager Billy Beane. Faced with a limited budget, the A’s challenged baseball orthodoxy, which traditionally relied on subjective scouting and expensive star players. Instead, Beane adopted a data-driven approach, identifying undervalued players whose skills—such as high on-base percentages—contributed to winning games. This method allowed the A’s to compete with wealthier teams like the Yankees, despite spending significantly less on payroll.

In Moneyball, Billy Beane explains, “Your goal shouldn’t be to buy players. Your goal should be to buy wins. And in order to buy wins, you need to buy runs.” The strategy led the A’s to a record-breaking 20-game winning streak in 2002 and reshaped how professional sports evaluate talent and revolutionized baseball by focusing on undervalued metrics rather than star players (defense primes).

Similarly, defense agencies could benefit from prioritizing smaller firms with niche capabilities over creating another generation of mega-contractors.

Any approach should involve:

Decentralizing procurement: Streamlining acquisition processes to make it easier for startups to compete without needing extensive compliance infrastructure.

Focusing on outcomes: Shifting from rigid requirements to outcome-based contracts that reward effectiveness over pedigree, consistent with the recommendations of General James Rainey, “We don’t have a technology problem, What we have is a technology adoption problem.”

Leveraging dual-use technologies: Encouraging commercial innovations with military applications—like SpaceX's Starlink—rather than relying solely on defense-specific R&D.

Adopting smarter metrics: Using readiness assessments (TRL/IRL), supply chain resilience evaluations, and scalability potential as key indicators of success.

The activity of innovation acquisition and adoption aren’t nearly enough to ensure strategic and operational deterrence, we need a clear ability to show how we will adapt and win.

NNCTA: "Securing America's Future: A Framework for Critical Technology Assessment"

The report outlines the urgent need for a structured approach to evaluating emerging technologies in the context of U.S. competitiveness and national security. It highlights how shifts in global geopolitical and economic dynamics, coupled with domestic challenges necessitate a robust framework for assessing critical technologies. The CHIPS and Science Act mandate such efforts, requiring the development of a Quadrennial National Technology Strategy.

NNCTA, funded by the National Science Foundation (NSF), conducted a one-year pilot to address these needs. The pilot focused on four critical technology areas: artificial intelligence (AI), semiconductors, biopharmaceuticals, and energy/critical materials. These areas were chosen to demonstrate methods for assessing technology interdependencies, commercialization bottlenecks, labor impacts, and equity considerations. For example, AI's role in accelerating advancements in semiconductors and biopharmaceuticals was explored alongside supply chain vulnerabilities in energy materials.

It identified gaps in data, analytic tools, and organizational structures needed to guide selection and investment in emerging technologies. This challenge extends well into defense agencies around the world.

Conclusion

While fostering next-generation primes like Anduril and Palantir is an important step toward modernizing defense capabilities, it may not fully address the Pentagon's need for speed and adaptability in today's rapidly evolving threat landscape. A "Moneyball" strategy, focused on buying wins through smaller, specialized players—would complement this effort by delivering high-impact solutions without the overhead of creating new mega-contractors.

Findings from the NNCTA reinforce the need for tools to evaluate readiness systematically, align investments with mission-critical needs, and ensure scalability across sectors. By adopting smarter metrics and leveraging structured assessment platforms, defense agencies can redefine how they maintain technological superiority while fostering a diverse ecosystem of innovators.

Ultimately, achieving this vision will require overcoming entrenched bureaucratic challenges and adopting flexible acquisition models, something that the Department of Government Efficiency might address, but the payoff could be truly transformative: faster innovation cycles, reduced risks, and sustained global leadership in critical technologies.